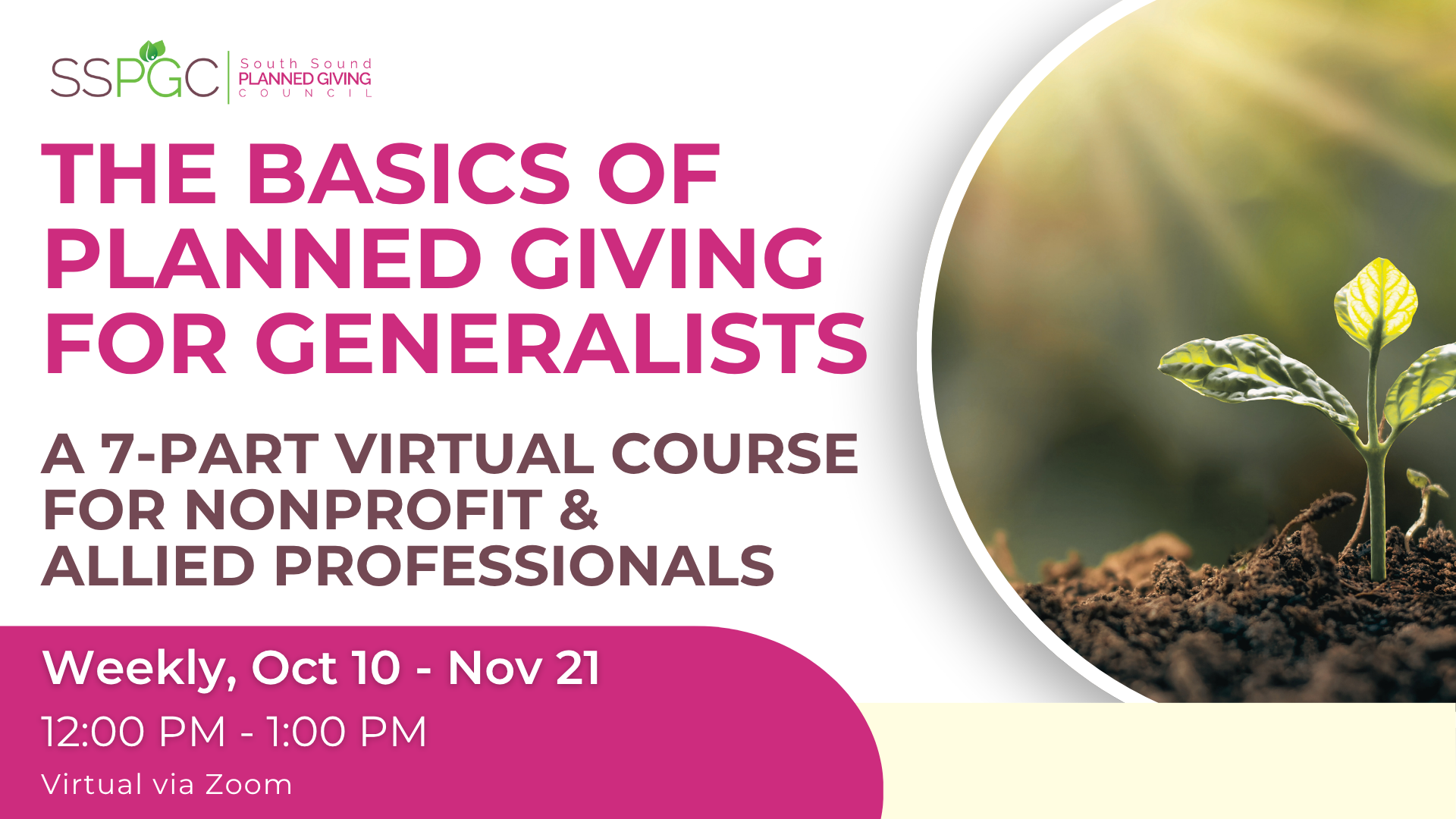

The Basics of Planned Giving for Generalists

A 7-Part Virtual Training Series | Fall 2025

Fridays & Wednesdays | Oct. 10 – Nov. 21, 2025 | 12:00–1:00 PM PT

💻 Virtual via Zoom | 💲 $199 for full course

This foundational training is designed for fundraisers, advisors, board members, and professionals who work with individuals considering charitable giving as part of their estate or financial plans. Whether you’re new to planned giving or want to strengthen your fluency, this seven-part series offers a well-rounded understanding of key vehicles and strategies.

Each one-hour session is taught by experienced professionals from law, finance, and nonprofit development, with practical examples and plenty of time for questions.

Instructors:

- Kaarin Austin, JD – KNKX Public Radio

- Brianne Kampbell, JD – Kampbell Legal Planning, PLLC

- Rick Oldenburg, CAP® – Oldenburg & Associates

- Doug Page, CAP® – Greater Tacoma Community Foundation

- Jeanne Sacks, CPA, CGMA, CAP® – Johnson Stone Pagano P.S.

- Hayden Taylor, JD – Eisenhower Carlson PLLC

Cost & Membership Offer

- Course price: $199

Special offer – Full course plus 15-month SSPGC membership for new members: $299 (membership through Dec 2026)